Banks Improve Their Reputations by Effectively Communicating in A Crisis

Corporate Reputation11 Sep, 2020

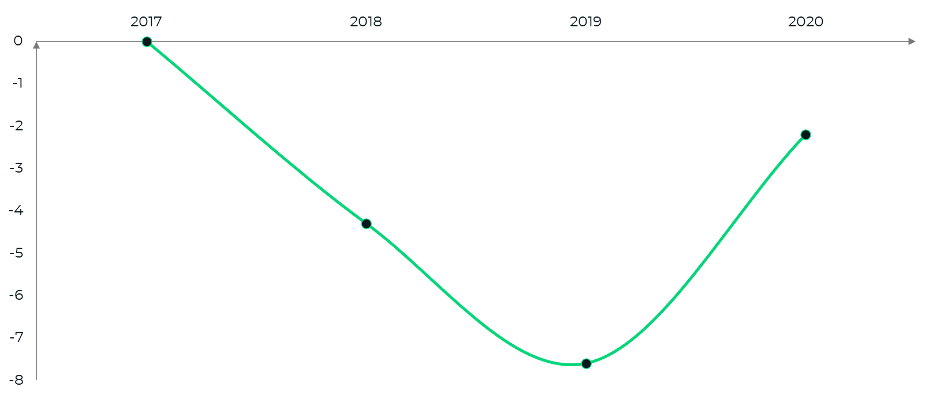

Bolstered by the goodwill that banks have generated by helping customers and employees weather the pandemic, bank reputations are once again on the rise after dropping for the past two years. In our annual study with the American Banker, we see that the pandemic has changed how people think about banks for the better; banks are now seen as more ethical, transparent, and providing better products and services. How did they do this? By communicating effectively when people needed them most.

Banking Industry Reputation Score Change 2017-2020

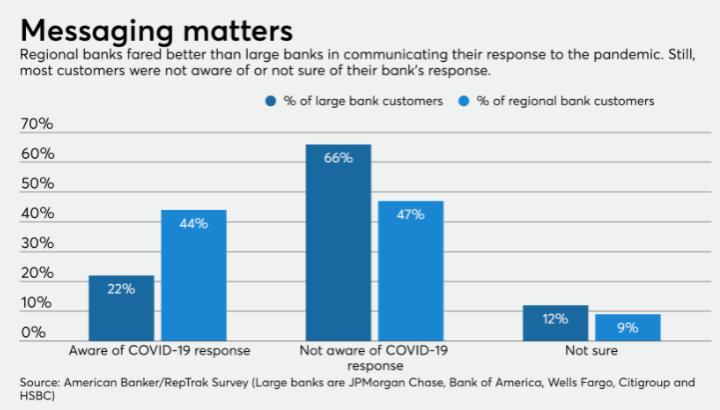

In previous crises, banks were often cast as the villain. This time, with the economy in tatters and widespread economic pain for businesses and consumers, banks that proactively communicated their COVID-19 plans with their customers have reputation scores up to 24.5 points higher on a scale of 1-100 compared to those that didn’t.

People who remembered a bank’s communications or actions gave an average reputation score of 82.6 to that bank – 82.6 is considered an “excellent score.” In comparison, people who were familiar with a bank but did not remember receiving any COVID-19 communications or actions by that bank gave an average score of 58.

Given the strong payoff of effectively communicating COVID-19 responses to employees, customers and the public in banking, all industries should consider ramping up their communications efforts and make sure they are reaching their intended audiences. Click here for best practices on how to communicate in a crisis.