2023 Corporate Trust Report: Industry Benchmarks

Industry Specific Insights17 Mar, 2023

Trust serves as the bedrock for our relationships, including those with our favorite brands. It elicits an inherently emotional response, and its global decline threatens to change how stakeholders buy, invest, and talk about your organization.

Like most aspects of reputation, Trust is down over the past year – settling at an Average 68.0 (▼0.6). This Trust decrease may not feel drastic, but this is a potentially dangerous trend. We’re here to deliver the early warning. Trust serves as the crux of emotional bonds with organizations, so we measure both the act and feeling of trust throughout our intense reputation measurement processes. In fact, on average, Reputation Scores are 91% correlated with Trust to do the Right Thing. So, the decrease we see in Reputation Scores (now in the Average range at 69.6, ▼1.4-points YoY) is less surprising.

Most important factors in influencing Trust to do the Right Thing.

The decline seen across the reputation score board indicates a thorough frustration not just with extraneous market factors, but with how organizations, and industries, are conducting themselves.

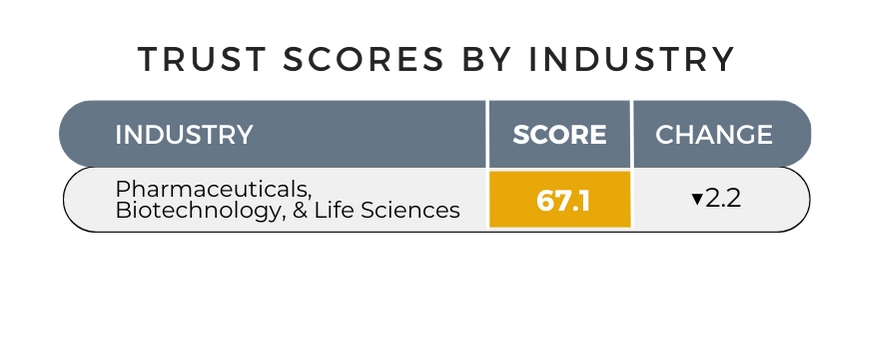

Pharma v. Itself: Industry Scores

RepTrak’s Industry insights and benchmarks provide an even closer look into these frustrations.

Pharmaceuticals, Biotechnology & Life Sciences (▼2.2) saw the largest YoY decrease out of any industry. We explored Pharma’s steady slide in our 2022 Pharma Update. In 2021, Pharma was riding high on the buzz of COVID vaccine deployments, and their Reputation Scores soared. But once everyone got their boosters and the masks came off, the public remembered the sins of Pharma’s past: the ravages of the opioid epidemic, price hiking, medication shortages… Pharma’s return to business-as-usual reminded the public that they weren’t angelic medical saviors, they’re a business.

When the conversation switched from COVID to Monkeypox to TikTok and celebrity influencer off-label medicine use (like non-diabetic use of Ozempic® for weight loss), the public felt serious Pharma burnout, and trust began to falter as the haunting memories of quarantine began to fade – and corresponding Pharma Trust and Reputation Scores took a dive in 2022.

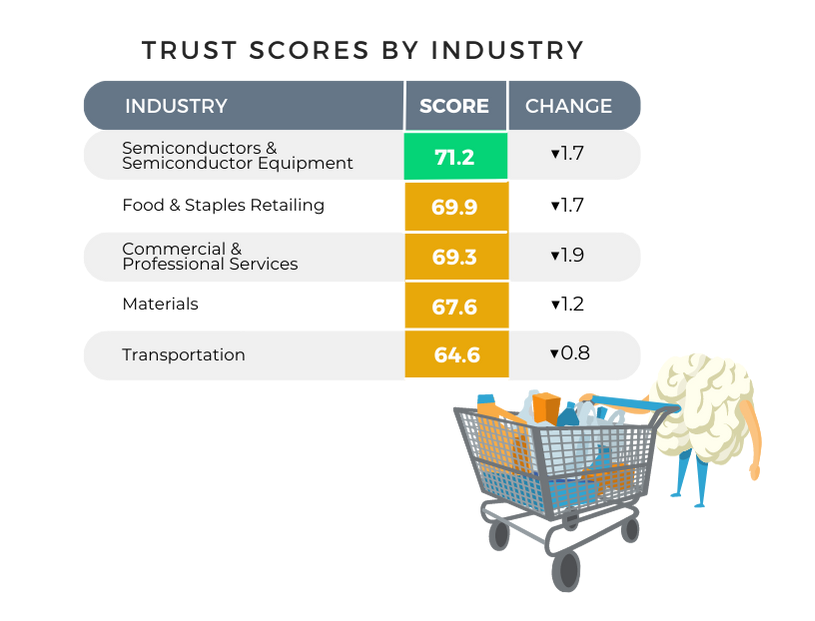

Before you snark at Pharma, remember that most industries experienced a downturn in Trust Scores for the same reasons. The warm fuzzies of “all of us, together” during the Pandemic had stakeholders feeling nice and cozy. Then, when the New Normal started to bring business back to stasis or unfavorable Pandemic conditions extended past quarantine, the public was rattled and Trust Scores responded. Materials (▼1.2) shortages continued and were felt across industries, including Semiconductors & Semiconductor Equipment (▼1.7). Commercial and Professional Services (▼1.9) conducted massive layoffs and a mandatory return to office. Transportation (▼0.8) had a hard time adjusting to the surge of post-pandemic travel. And unexpected price hikes made it difficult to determine the difference between inflation side effects or greedy profit snatching, leaving its mark on Food Staples and Retailing (▼1.7) and grocery trips nauseating.

Folks were in a hurry to get back to “normal.” And the New Normal, was not what they were anticipating. Brands lost their predictable consistency or, dare we say, maintained too much consistency by continuing old, bad habits...

How RepTrak can help build trust

Stakeholders are letting you know they are disappointed across nearly all aspects of reputation, across the world, for most industries. And their trust is wavering as a result.

RepTrak metrics are never permanent (one of the benefits of near-real-time reputation monitoring). Trust and Reputation Scores rarely stay the same, you are either getting better or you are getting worse. It’s always the right time to start doing what’s right. Then, stakeholders can Trust [you] to do the Right Thing.

RepTrak tracks corporate reputation and trust perception objectively and in-near-real time, meticulously monitoring your Reputation Drivers, ESG Drivers, Brand, and Industry Insights—and how your efforts and communication impact your audience's trust and your broader reputation.

Our advanced metrics paired with our expert Advisors provides crucial insight and informs powerful and practical strategy while measuring effectiveness so you know exactly what is changing hearts and minds.