2022 Tech Report: Tech ESG

Corporate Reputation28 Sep, 2022

Our Ultimate ESG Guide demonstrated ESG's importance as a new business standard. This sentiment (and data) rings true across industries, and our 2022 Tech Reputation Report saw a decline in Tech's ESG scores.

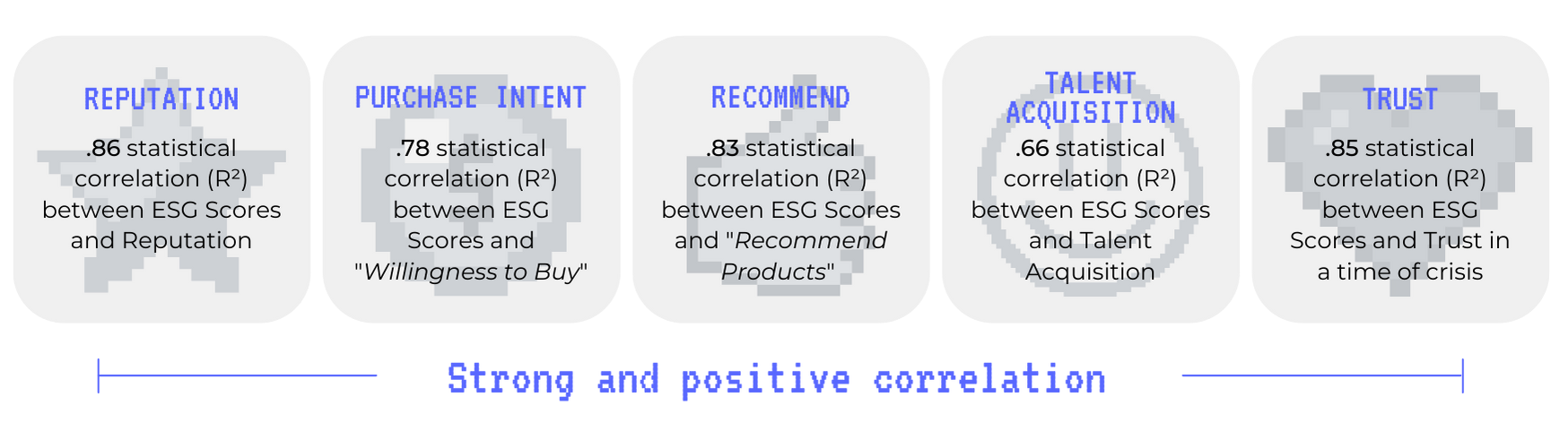

ESG (Environmental – Social – Governance) is a measure of an organization’s (or in this case, industry’s) specific ethical efforts. It’s a globally recognized standard valued by investors, consumers, and employees alike, shaping reputation and public response. Corporate ethicality isn’t just a warm fuzzy, it’s a powerful element that distinctly impacts consumer behavior, investment prospects, and employer branding. This makes it a handy tool for mitigating risk.

Tech Triple Threat.

Our corporate reputation database is so robust that our Tech Report analyzed Technology Hardware & Equipment and Software & Services as separate industries, giving us an even deeper understanding into Tech’s broader evolution. But that wasn’t enough to satisfy us. For this report only, we’ve created a novel industry we’re calling “Media & Entertainment Technology” taken as a subset from our broader Media & Entertainment industry measurement, to incorporate social media organizations, entertainment streamers, and video game companies not included in our Hardware and Software industries.

Tech should be worried about its decreasing ESG Scores.

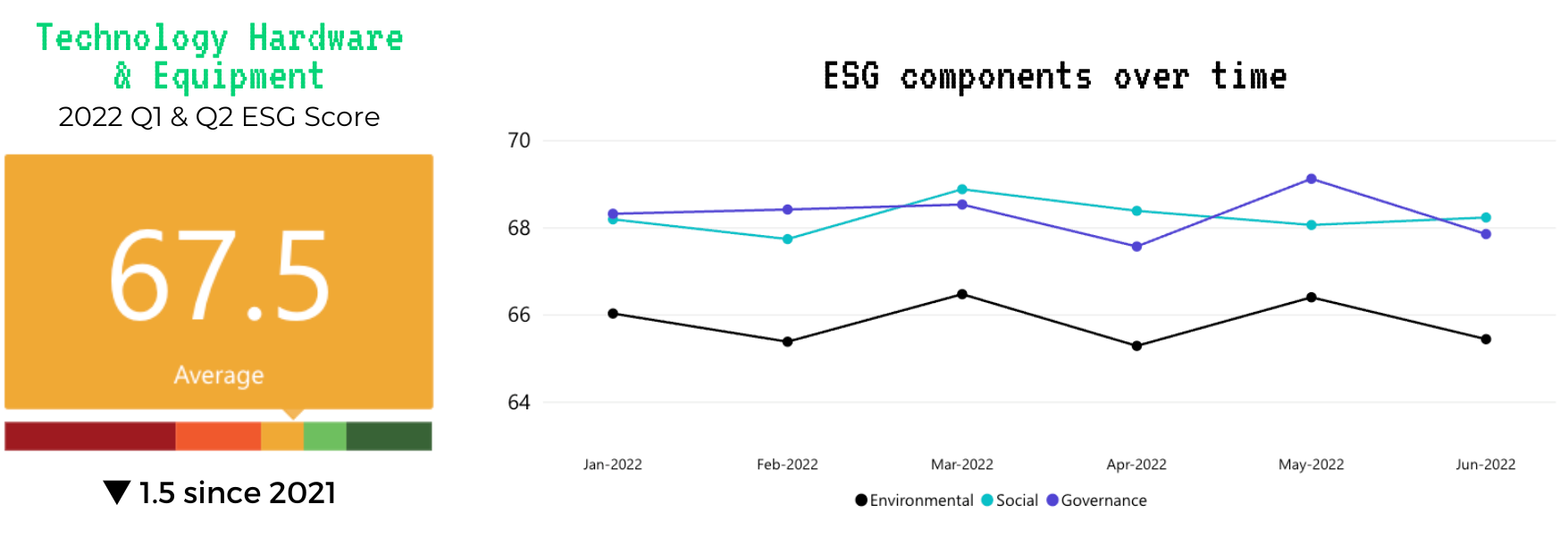

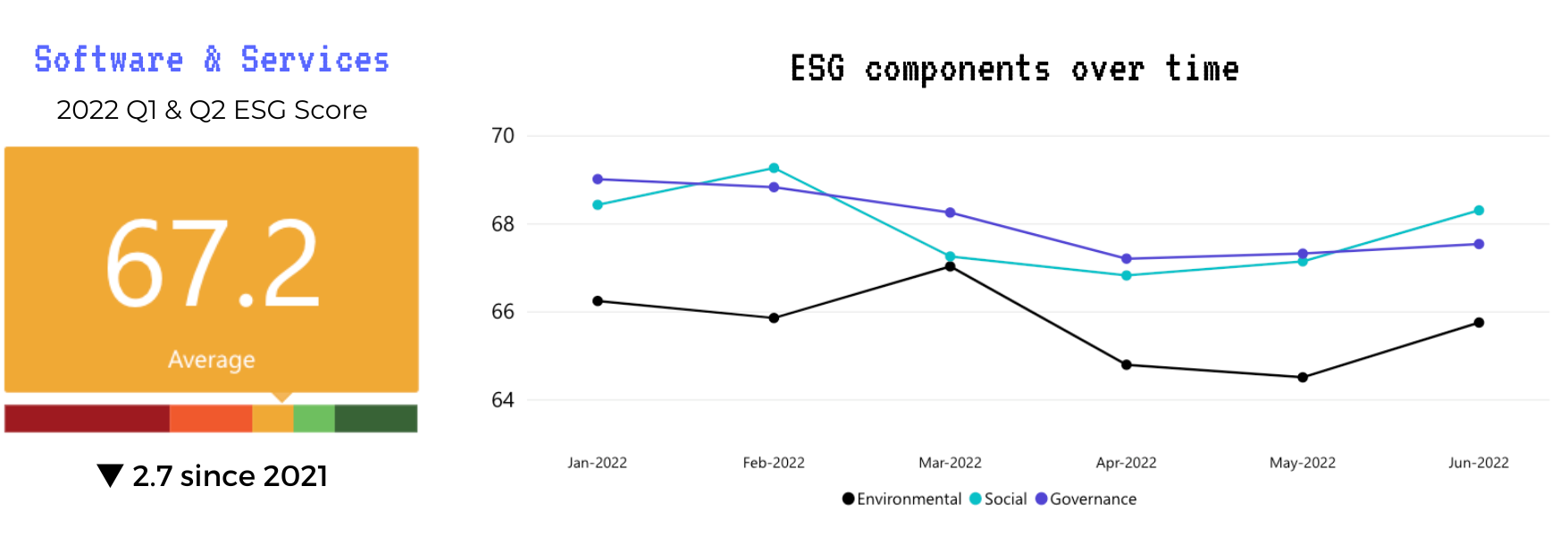

We separately measured the ESG Scores for Hardware, Software, and Media & Entertainment, but they're all down across the board.

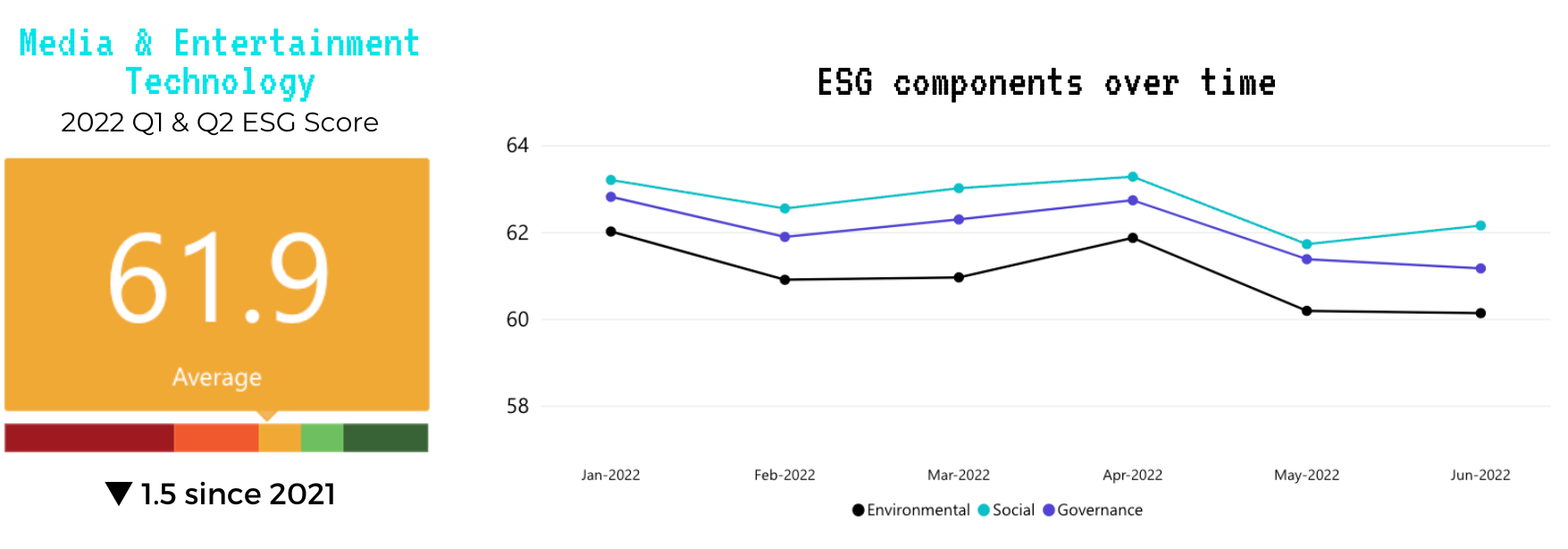

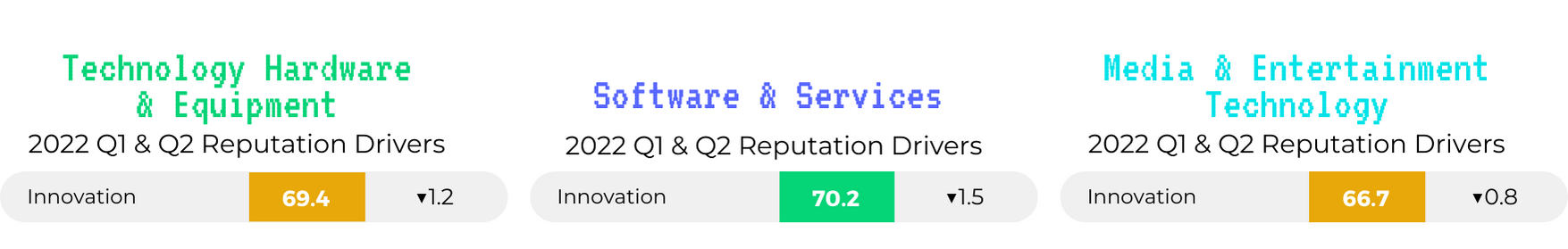

Again, all three industries are experiencing the same phenomena: an ESG downturn. And, like reputation, they aren’t the only ones. Global ESG Scores saw a 0.8-point YoY decrease from 2021 to 2022, with individual Environmental, Social, and Governance Scores all decreasing. The public is frustrated with Tech and big business in general. The medical, social, and environmental conflict of 2020 prompted deliberate responses from organizations who claimed, “We’ll get through COVID together,” and, “#BLM,” and, “We promise to do better,” in 2021. But 2022 was the time to fulfill those promises, and those same organizations came up short – in Tech and beyond.

With such a prominent role in day-to-day life, Tech news is easy to keep up with. And much of Tech practices tend to be ahead of the curve on ESG topics, like environmental pledges and favorable workplace practices. But Tech’s prominence allows the public to stay on top of the latest scandals and advances, the public notices the making and breaking of those promises. Remember, these are ESG perception metrics – and what the public remembers becomes truth. A lot of tech companies tend to lead with environmental promises first, but recent RepTrak ESG data showed that Environmental considerations consistently rank as least important in comparison to Social and Governance factors. The most important ESG factor for reputation? For most industries and regions, it’s "Ethical and Fair Business Practices."

The warmth of Tech’s quick COVID pivot has worn off. Making services more accessible (like Zoom’s no-time-limit calls during the quarantine holidays), supporting the front lines, promptly switching to work from home, and continuous promises to reduce carbon emissions have faded into new and refreshed pre-pandemic concerns – particularly surrounding data usage and privacy, expansions and monopoly interests, and approaches to social issues. Even grand ESG gestures can come with a downside. Many Tech companies in the US, like Microsoft, Salesforce, HP, and Apple, have taken a progressive approach to gender and/or reproductive health, but even the ESG benefit of accommodating these needs can be diluted. Taking advantage of these policies would require employees to divulge private information about their gender identity, sex lives, romantic relationships, and physical health directly to their employers. Talk about a privacy breach. And employees and the public are fully aware of this double-edged sword (and that’s not even including those who disagree with these policies).

Not to mention that these policies are not available to all employees, especially not the part-time or temporary employees, independent contractors, and gig workers that much of Tech can rely on. The public has not forgotten that most of these folks do not have basic employer-provided health insurance. Offering to cover abortion-related travel costs for the limited number of reproductive age women-in-tech and child-bearers (non-binary and trans Tech workers can and do conceive), who have reached an employment threshold and just so happen to live in the states effected by the overturn of Roe v. Wade, can feel like missing the mark, an ambitious flourish with little result.

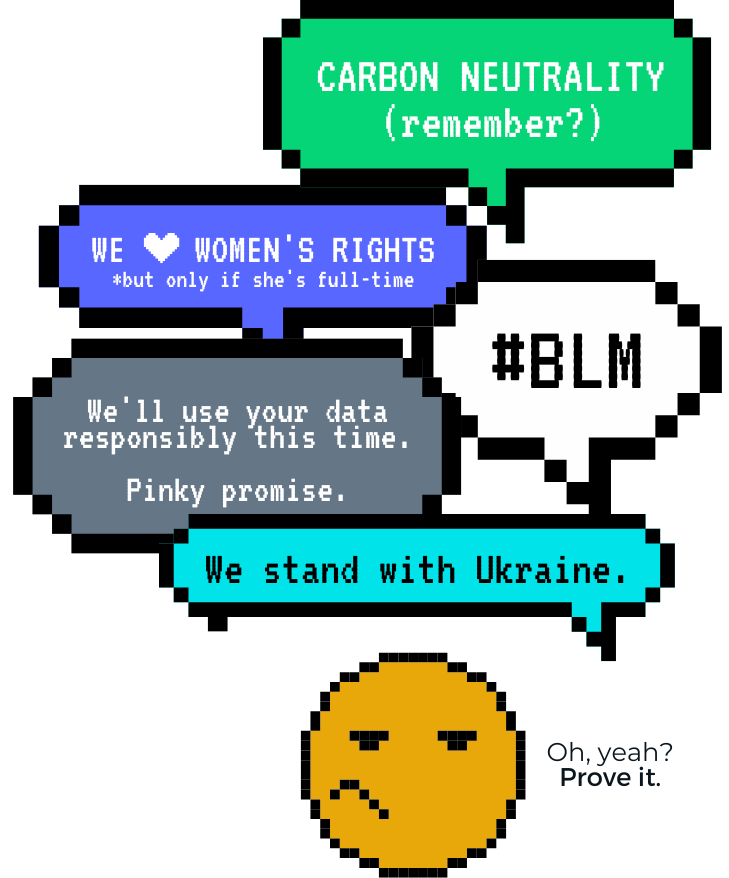

This doesn’t mean we recommend ceasing policies like this. RepTrak data confirms that companies with outspoken CEOs across social justice, environmental, and political issues have higher average Reputation Scores. We simply want to remind all organizations to do the basics well, in addition to these grand gestures. When “Ethical and Fair Business Practices” are a top ESG priority for stakeholders, flair won’t distract them from providing (or not providing) the fundamentals for employees and customers. Doing the basic things right is an innovative act, and Innovation Driver Scores are down across Hardware, Software, and Media & Entertainment Tech.

Earn those high Tech ESG Scores.

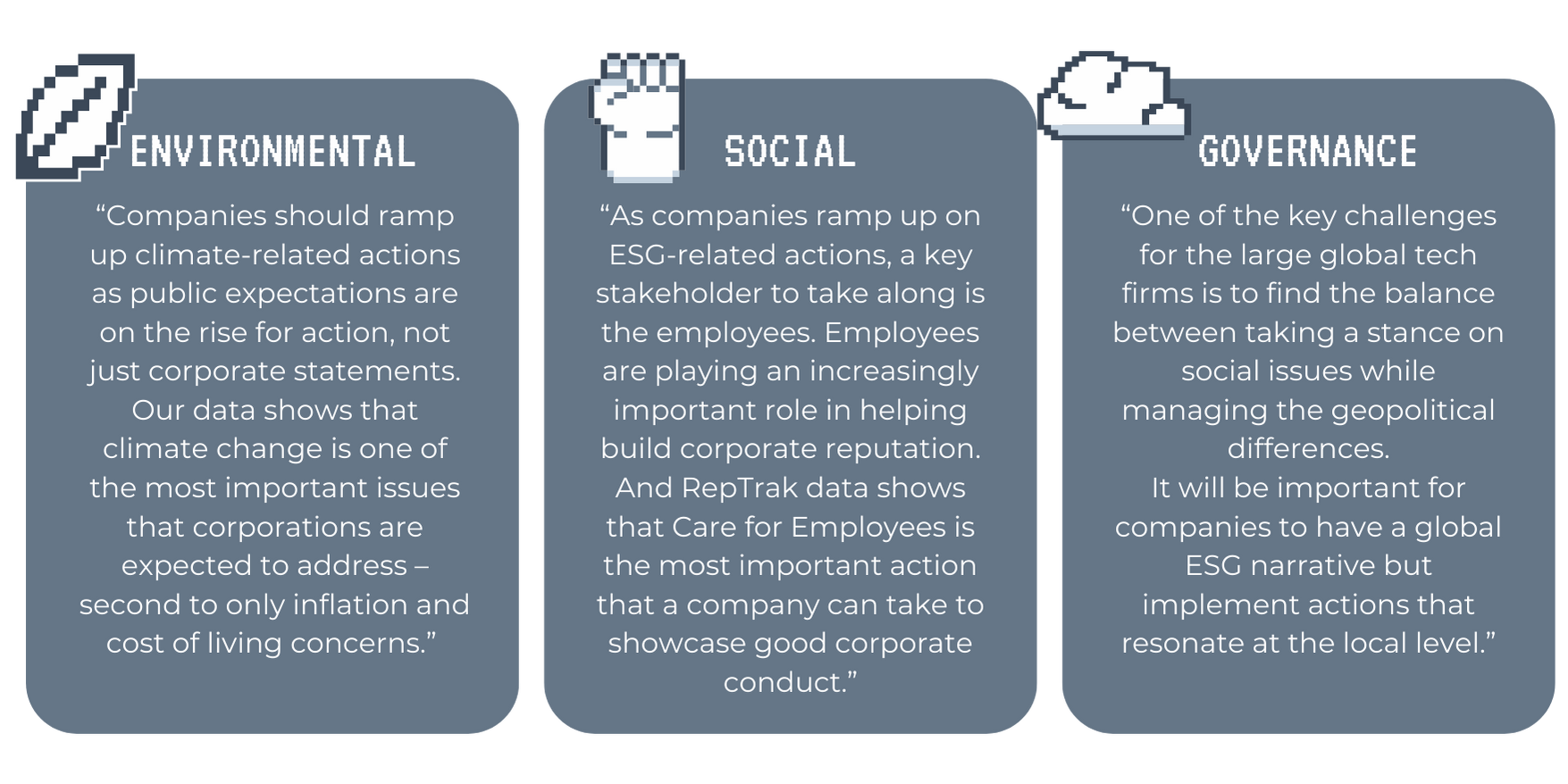

“While Innovation and Products remain core to the Tech industry, ESG is what will help companies differentiate themselves and build a strong reputation,” recommends Advisory VP Taniyah Beg. “Tech was a star in the throes of the pandemic: making work from home feasible, helping folks stay connected, and supporting the healthcare industry by leveraging global supply chains. This gave Tech ESG a temporary boost, pausing antitrust, free speech, and data privacy concerns. But now these are back to top of mind, especially as both the United States and European Union put in place new mandates around climate related actions. Year-to-date, the industries’ biggest perception declines have been in ESG.” To combat this ESG downturn, Taniyah has a recommendation for each letter in ESG:

It’s not just stakeholders who are making their ESG demands known, many of the tech organizations you may work with or alongside are requiring ESG commitments and disclosures, and if you don’t have anything to report, that could leave you in a tough spot in the RFP game. If your employees are disgruntled or turning over, sustainability is lacking, or governance policies don’t align, your poor ESG could damage another company's ESG by proxy. Good ESG requires a 360° approach, not just pledges to increase tech recycling and reduce CO2 emissions.