The Banking Industry’s Reputation in 2025

Corporate Reputation12 Sep, 2025

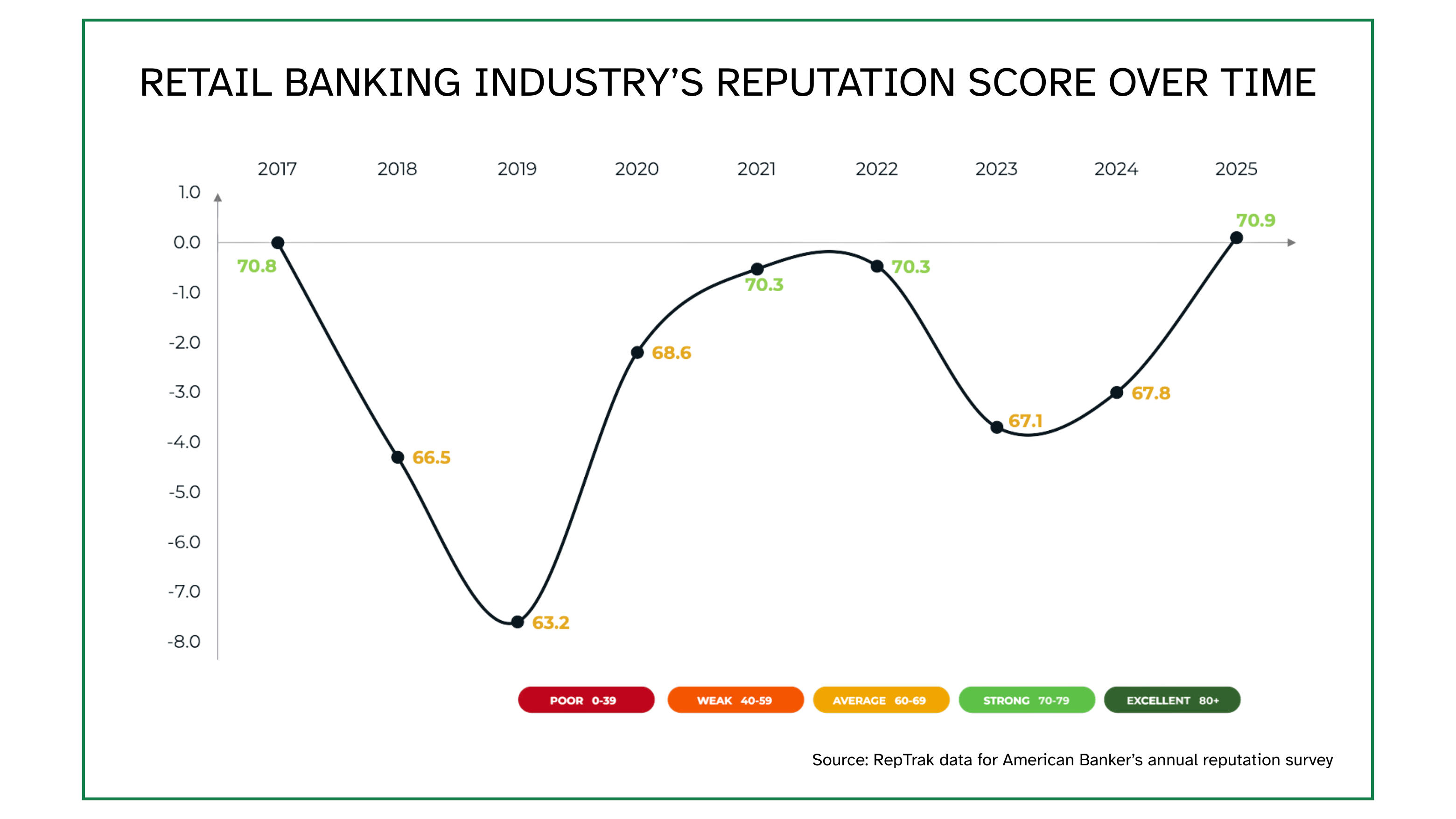

RepTrak's annual reputation study for American Banker reveals that the banking industry has recovered from the sharp reputational decline of 2023, reaching a Reputation Score of 70.9 — its highest in 8 years. Based on 15,000 ratings across 40 of the largest and most significant retail banks, the study highlights a split in the recovery: large banks regained the most confidence from their customers, while regional banks rebuilt trust among non-customers who had been most skeptical. Rankings are available to view within the full American Banker article.

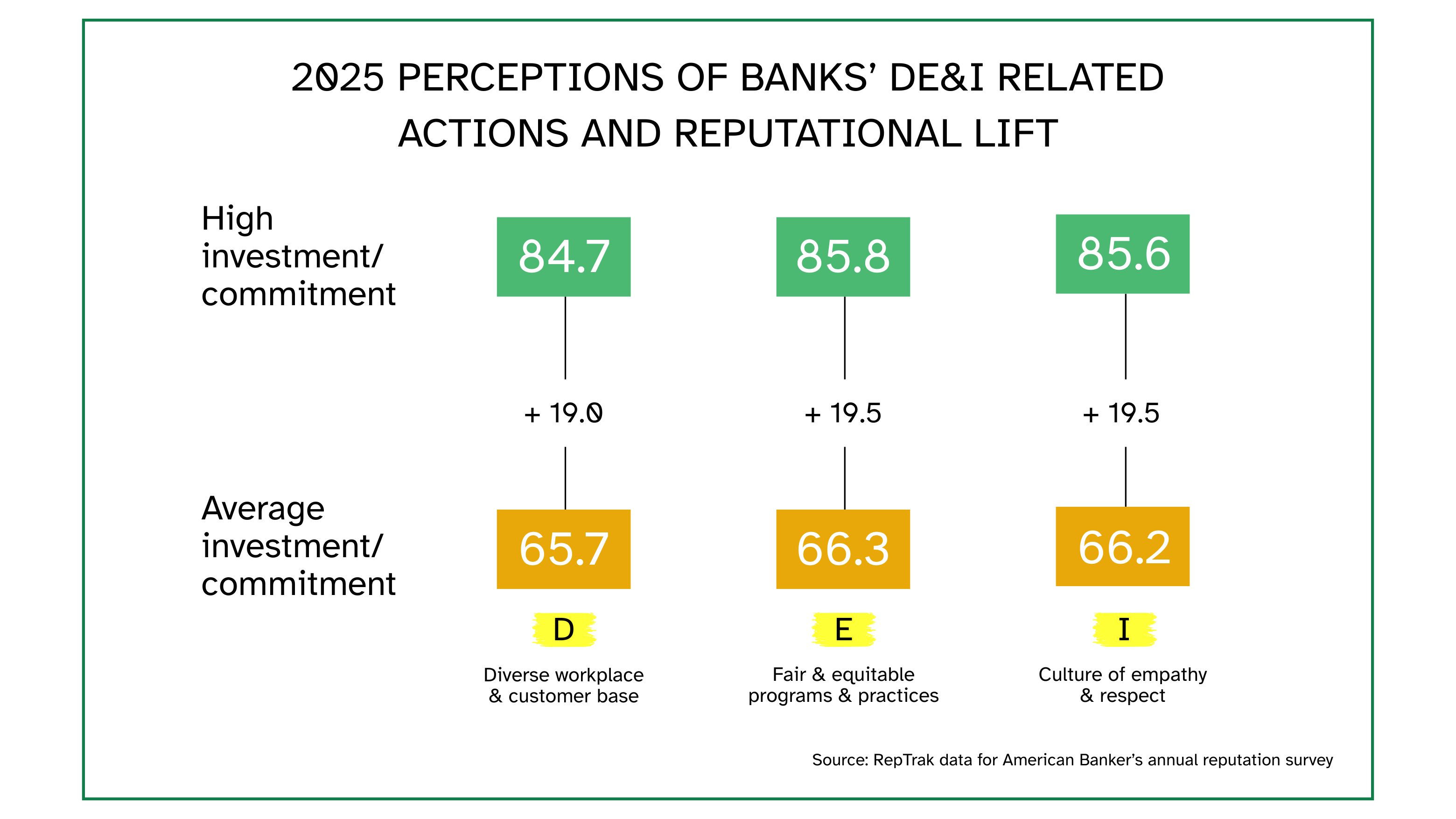

The research also shows that DE&I remains a reputation driver amidst growing polarization, with regional banks earning more recognition for their initiatives than large banks.

By examining shifts in stakeholder sentiment, the study provides retail banks with actionable insights into how to protect trust, respond to risk, and strengthen long-term reputation.

Banking's Reputation Reaches 8-Year High with 2025 Recovery

After the sharp, crisis-driven decline of 2023, the banking industry’s reputation has staged a recovery. According to the annual reputation study conducted by RepTrak in partnership with American Banker, the industry’s Reputation Score climbed to 70.9 in 2025 — the strongest Score in 8 years.

This study examines how banking reputations have evolved in the wake of the 2023 crisis, against the backdrop of a shifting political administration and ongoing global trade tensions. To capture an accurate picture, the study surveys a broad sample of stakeholders — including both customers and non-customers of large, regional, and non-traditional banks.

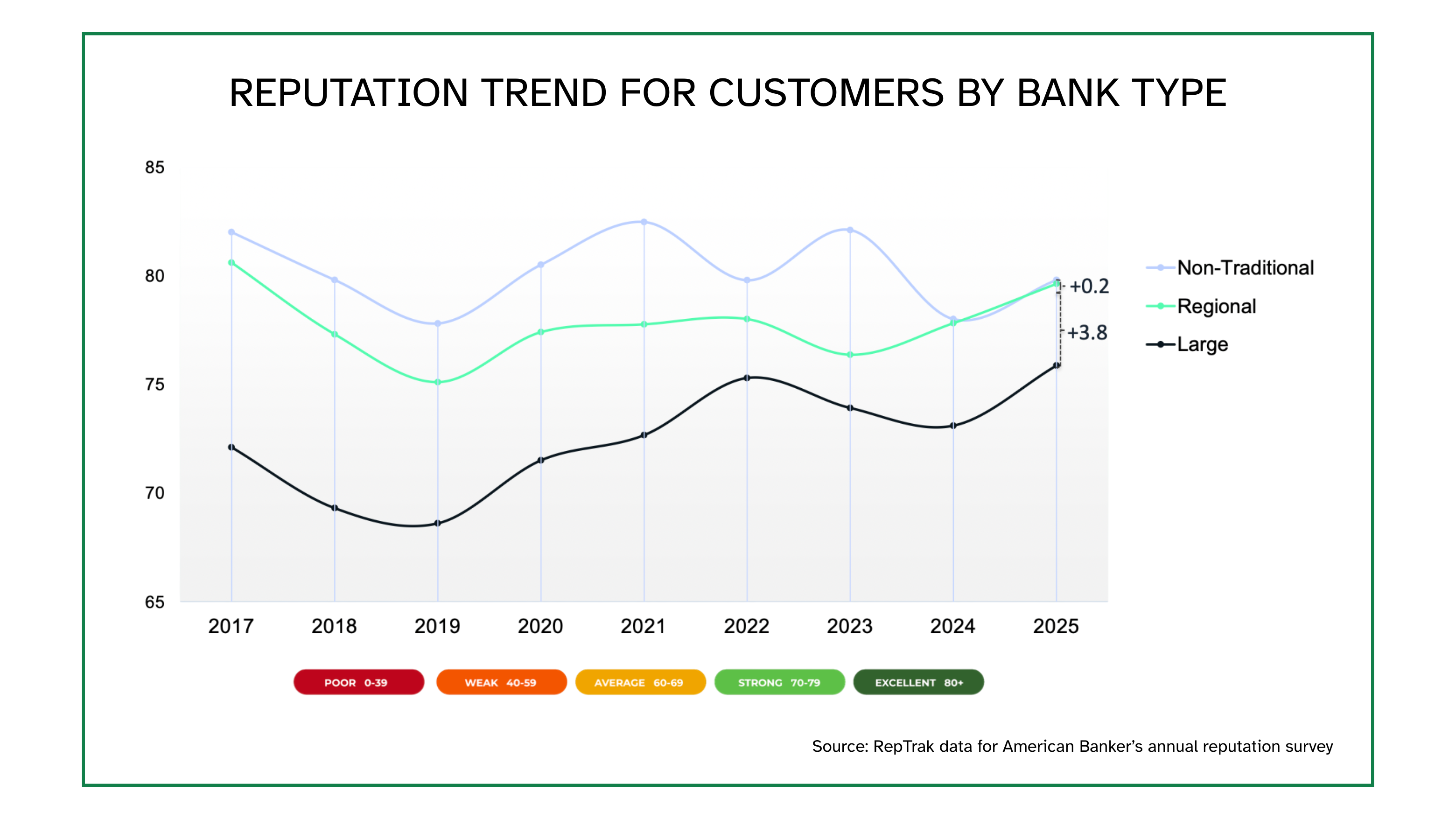

Customer Confidence Rebounds for Large Banks

This rebound reflects growing confidence amongst both the industry’s customers and the broader public.

Large banks saw the strongest reputational gains amongst their existing customers. After the turbulence of 2023, confidence in large institutions rose significantly, signaling that the actions these banks took to regain their customers’ trust were proving effective.

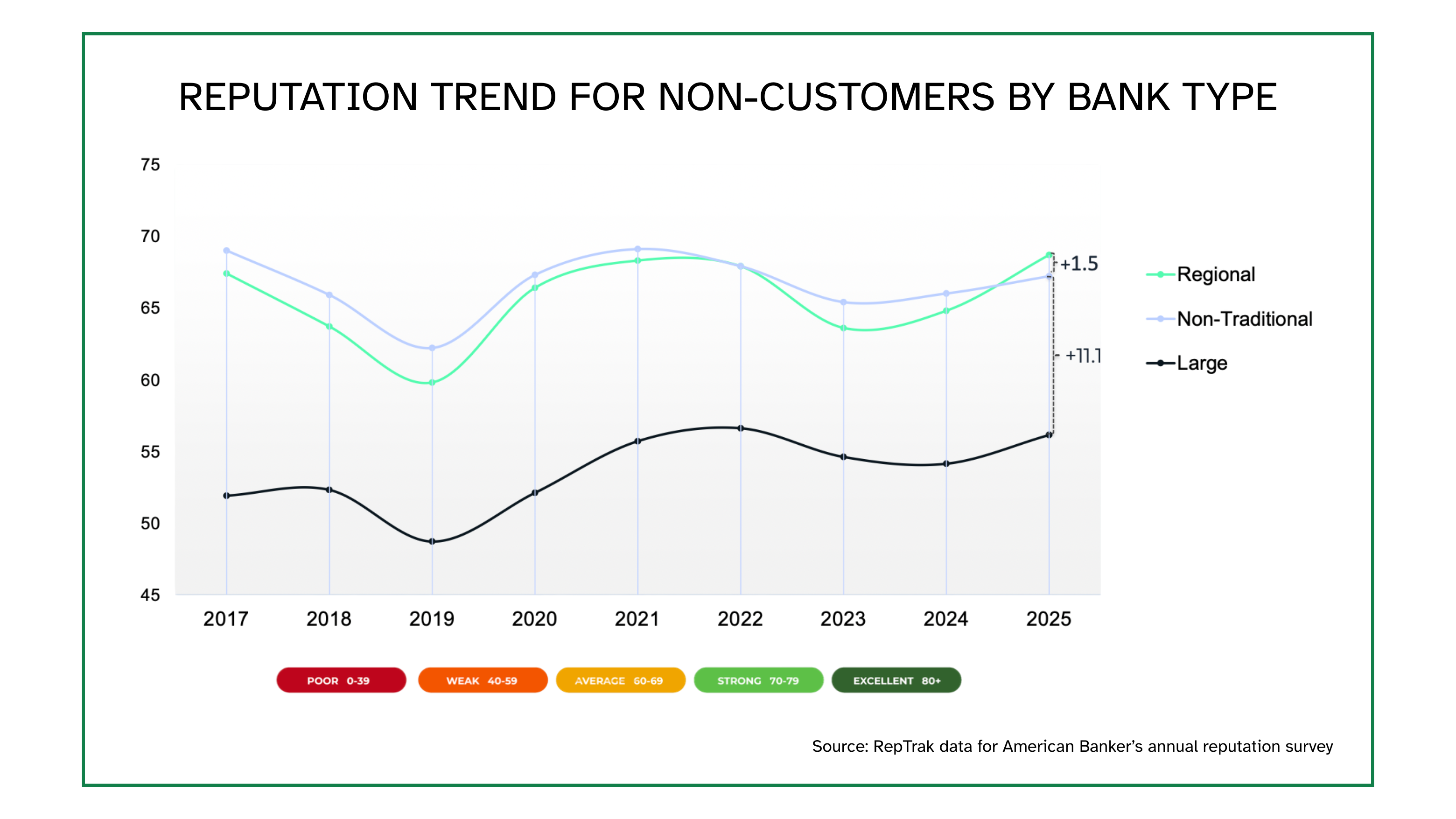

Regional Banks Rebuild Trust Among Non-Customers

Regional banks made the biggest strides with non-customers — the same group that had most severely lost favor with them during the 2023 banking crisis. This rebound underscores their ability to win back broader audiences who were once the most skeptical.

DE&I Remains a Reputation Driver Amidst Polarization

DE&I remains a reputation driver in banking, even as the terminology becomes more polarized. In 2025, regional banks receive more recognition for DE&I initiatives than large banks. Authentic actions rooted in DE&I principles continue to build trust, but perceptions differ across demographics — making stakeholder-specific strategies essential.

Read the full article from American Banker.

Frequently Asked Questions for the Banking Industry:

What’s the current Reputation of the Banking industry?

The Banking industry’s Reputation Score reached 70.9, its highest level in 8 years. This marks a recovery from the 2023 banking crisis and signals renewed confidence across stakeholder groups.

Where is the industry still facing pressure?

Stakeholders remain wary of regulatory shifts. Concerns over weakened oversight, fee structures, and capital requirements persist. Less than half of the public fully trusts banks to self-regulate, underscoring the reputational risk of falling short on transparency and responsibility.

How have regional and large banks’ reputations shifted since the 2023 banking crisis?

Regional banks achieved the largest reputational gains with non-customers, rebuilding their credibility with audiences that had sharply lost faith during the 2023 banking crisis. Large banks recorded the strongest improvements among their existing customers, as confidence in major institutions rose significantly. Together, these shifts show that reputation recovery in the banking industry requires different strategies for different stakeholder groups.

What role does DE&I play to improve corporate reputation today?

DE&I remains a key driver of reputation, even as the terminology itself has become more polarized. In 2025, regional banks are recognized more for DE&I-related actions, while large banks are seen as lagging. Authentic DE&I practices continue to deliver reputational benefits, but attitudes differ sharply by age, gender, race, ethnicity, and political affiliation — making stakeholder-specific strategies essential.

RepTrak for Industry: Financial Services Solutions

RepTrak partners with leading financial services companies — from banks and credit unions to investment firms and insurers — to measure, monitor, and manage reputation. Our Financial Services Industry solution helps leaders respond to today’s complex challenges with data-driven clarity:

For Banking Institutions: Track reputation drivers around your products and services, conduct, and regulatory transparency to strengthen customer confidence.

For Insurers & Investment Firms: Measure how ESG, DE&I, and risk management influence stakeholder sentiment and long-term loyalty.

For the Broader Financial Sector: Analyze how regulatory changes, AI adoption, and ethical practices impact perceptions across stakeholders — from customers to policymakers.

With RepTrak Compass™, all your reputation intelligence lives on one platform. Benchmark against peers, monitor real-time shifts, and connect your strategy directly to business outcomes — all with the guidance of RepTrak’s Advisory experts every step of the way.