Airline Reputation in 2025 is Climbing to New Heights

Corporate Reputation09 Oct, 2025

The skies may still be turbulent, but airlines are finding smoother air when it comes to reputation. After years of volatility, the sector has charted a course of steady improvement, climbing to strong reputation levels in 2025.

What’s driving this rebound? Stakeholders are rewarding progress in areas that matter most: protecting customers, treating employees fairly, and taking visible steps toward sustainability. The data reveals a story of resilience and momentum — one where incremental changes are beginning to reshape how the industry is viewed.

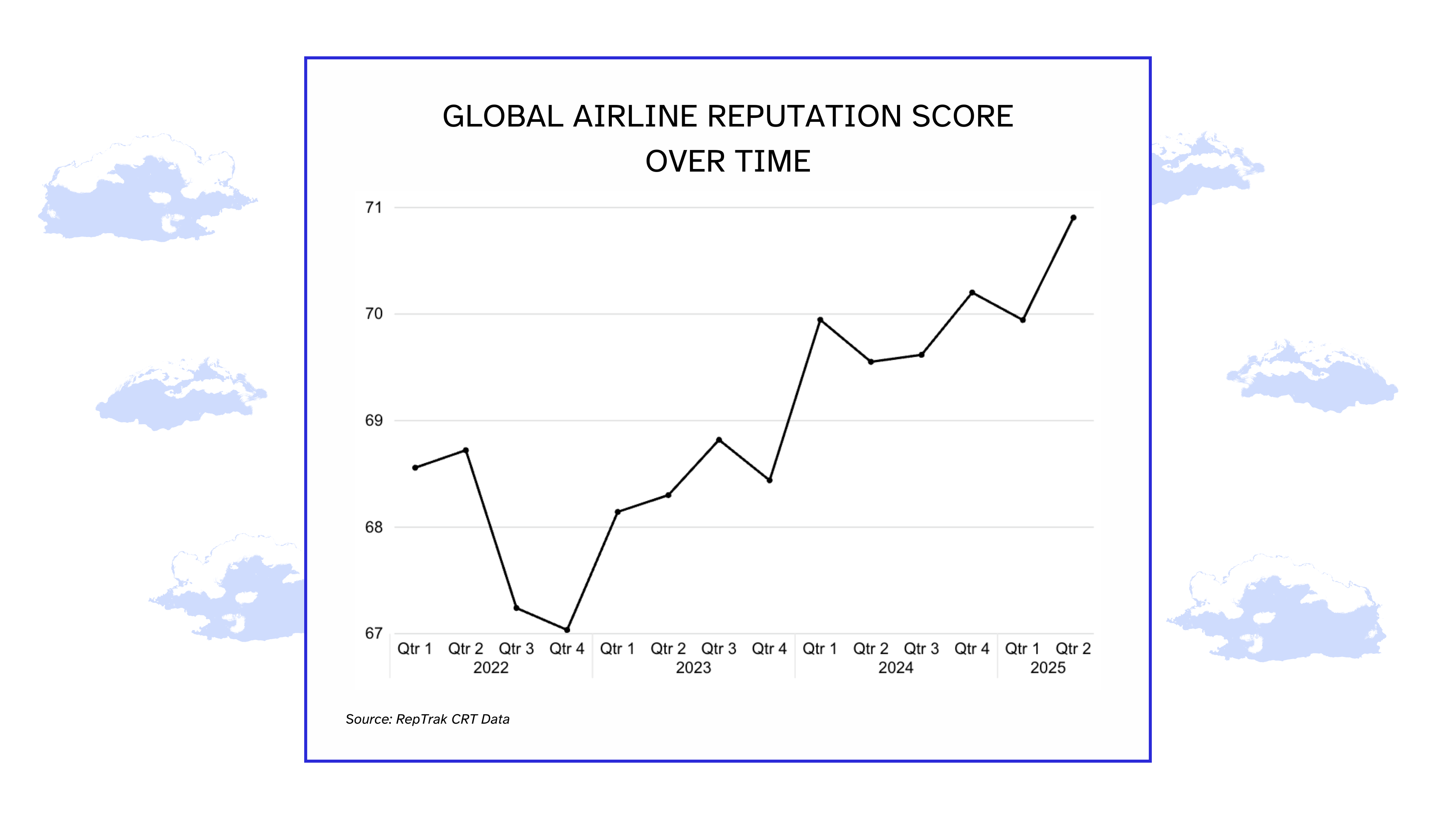

Reputation Score: A Steady Climb After Turbulence

The airline sector’s reputation has been on a journey of its own, reaching a Reputation Score of 70.9 in H2 2025.

After a sharp dip in late 2022 (when operational meltdowns, labor unrest, and soaring fares tested stakeholder patience) the industry began to rebuild. By early 2023, smoother operations, renewed labor agreements, and visible commitments to accountability and responsibility helped restore favor.

That momentum has only grown, with airlines now at their strongest reputation levels in H1 2025, as stakeholders recognize meaningful progress in customer protections, sustainability, and employee treatment.

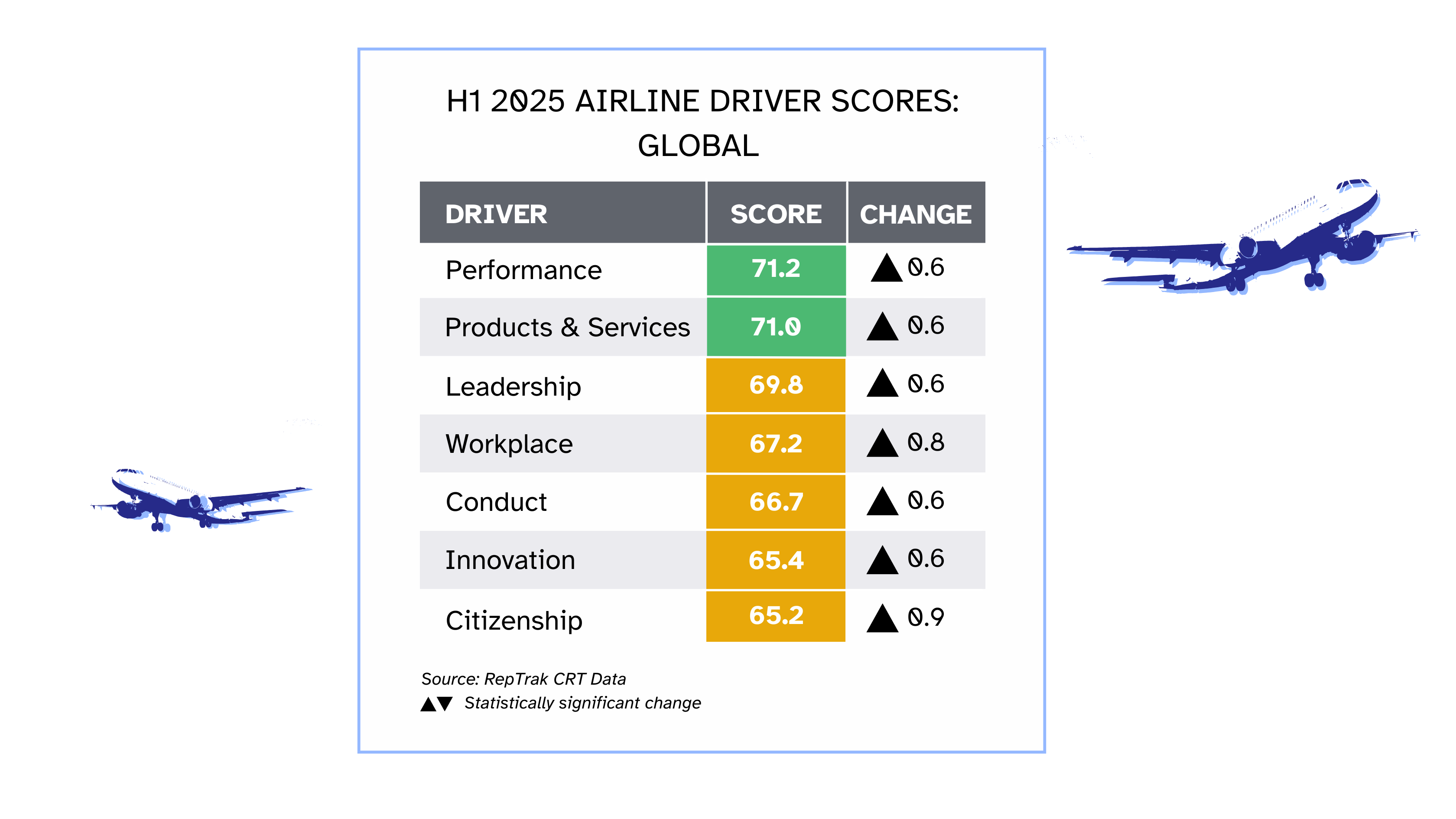

Drivers of Reputation: People and Purpose Leading the Way

The improvement carries through to the Drivers of Reputation, which reveal why people think the way they do about specific areas of business. Looking at the H1 2025 Scores, all Drivers are up at least 0.6 points — a clear sign that industry efforts are resonating across the board.

Workplace (+▲ 0.8): Stakeholders are noticing new labor agreements, improved training, and fairer treatment of employees. Airlines are being rewarded for investing in the people who keep them moving.

Citizenship (+▲ 0.9): The largest gain of any Driver. Though still the lowest overall score, this reflects recognition of airlines’ efforts to tackle environmental impact and strengthen their social footprint. From sustainable aviation fuel to carbon reduction initiatives, visible action is beginning to shift perceptions.

Together, these gains suggest that airlines are not only repairing credibility but actively building momentum. Improvements in Workplace and Citizenship show that progress in people and purpose is reshaping how stakeholders view the industry — laying a stronger foundation for long-term favor.

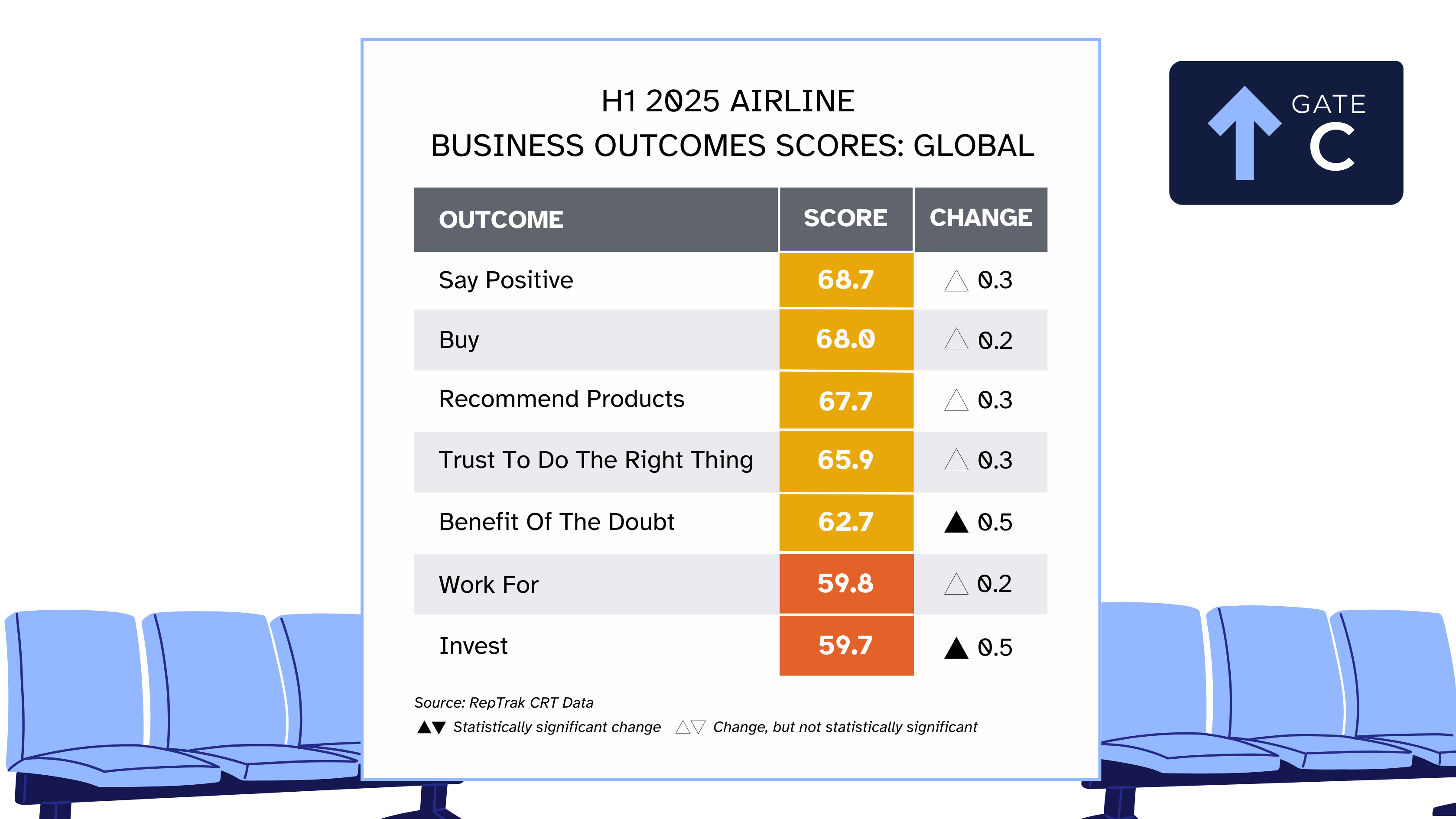

Business Outcomes: Signs of Cautious Optimism

Only two out of seven Business Outcomes are showing statistically significant increases in H1 2025 — Benefit of the Doubt and Invest, each rising by ▲ 0.5 points.

Benefit of the Doubt: Signals that stakeholders are more willing to give airlines room to recover from missteps — a critical restoration of trust after years of high-profile disruptions.

Invest: Indicates stronger confidence from financial stakeholders, who see airlines as more stable and better positioned for the long term, supported by sustainability initiatives and workforce agreements.

Other outcomes (including Buy, Recommend, and Trust to Do the Right Thing) are edging upward, but not yet at statistically significant levels. This highlights that while reputation is improving, consumer decisions remain cautious and fragile.

The Next Test for Airline Reputation

The message is clear: reputation recovery in airlines is underway, but the journey isn’t finished. Gains in Workplace and Citizenship show that stakeholders are paying attention to people and purpose, while improvements in Benefit of the Doubt and Invest suggest growing confidence in long-term stability.

Still, the next big test will be delivering consistent reliability and meaningful innovation — areas where expectations remain high and patience is thin. If airlines can pair operational excellence with their recent progress in responsibility and trust, they will not only sustain today’s momentum but also secure lasting credibility in the years ahead.

Frequently Asked Questions

1. What is RepTrak's Reputation Score?

RepTrak’s Reputation Score just one element in our comprehensive data suite. This Score is derived from stakeholder ratings across 4 statements that collectively measure trust, admiration, respect, and overall sentiment — providing a comprehensive, data-driven measure of your reputation.

But that’s only the beginning. Our proprietary model goes beyond a single score to capture how stakeholders think, feel, and act toward your company — revealing the full picture of your reputation’s impact.

2. Why did airline reputation fall in 2022?

Reputation dropped sharply in late 2022 due to widespread operational meltdowns, staffing shortages, labor disputes, and fare hikes. These issues exposed gaps in performance and leadership, damaging trust and patience among travelers and stakeholders.

3. What explains the rebound in 2025?

By 2023, airlines began to recover with smoother operations, new labor agreements, and clearer commitments to accountability. In 2025, stakeholders are rewarding progress in customer protections, sustainability, and employee treatment — leading to the industry’s strongest Reputation Score in years (70.9).

4. Which Drivers of Reputation improved the most?

The most significant gains came in Workplace (+▲0.8) and Citizenship (+▲0.9). Airlines are being recognized for fairer treatment of employees and for advancing sustainability through initiatives like sustainable aviation fuel, carbon reduction targets, and more transparent reporting.

5. How are Business Outcomes influencing airline stakeholder behavior?

Reputation improvements are starting to shift stakeholder behavior. In 2025, Benefit of the Doubt and Invest showed statistically significant gains, signaling restored confidence in airlines’ stability and long-term prospects. While outcomes like Buy and Recommend are rising, they remain fragile — highlighting the need for continued progress in reliability and innovation.