Q1 Data Dose

Corporate Reputation25 May, 2022

Following our 2022 Global RepTrak report, even more 2022 data is coming in hot! And you’ll want to know what we’re seeing... Thirteen out of eighteen industries decreased significantly QoQ in Reputation Score. Previous leaders are showing the largest fall. And some surprising industries are climbing their way to the top in certain areas.

Buckle up. We’re taking a ride on the windy road of Reputation.

In navigating the ebbs and flows of our post-pandemic world, our U.S. Q1 data shows that as more consumers leave the confines of their home, their purchasing power is taking some industries to the top while forcing others into a shocking downturn.

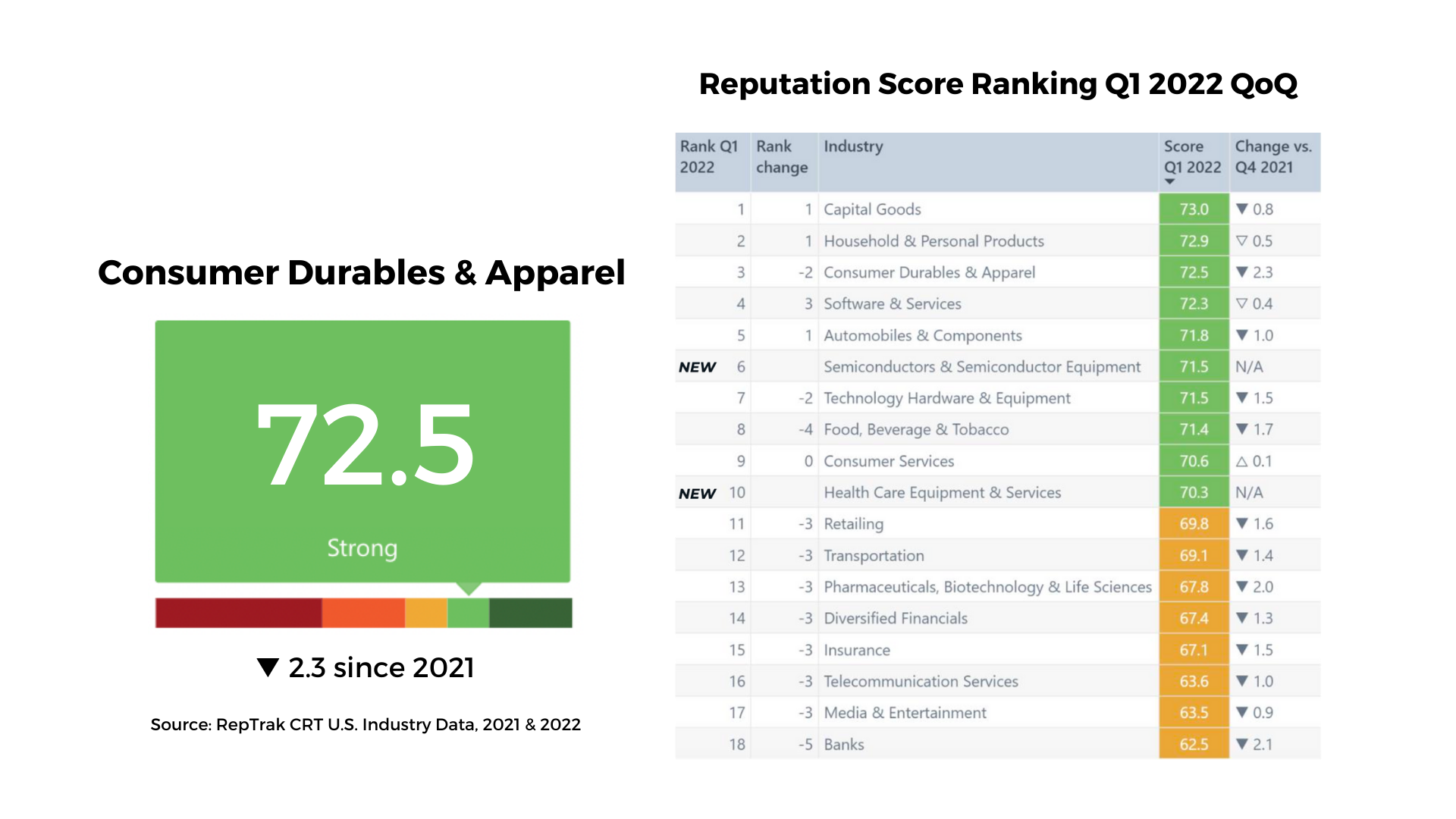

Reputation Score Ranking Q1 2022 – 13 out of 18 industries saw a decrease in Reputation Scores.

Consumer Durables & Apparel have the largest decline in Reputation Score, dropping 2.3 points from Q4 2021.

Household & Personal Products started trending down in January 2022, falling by 2.6pts in 3 months.

BEEP BEEP! Let’s Ride

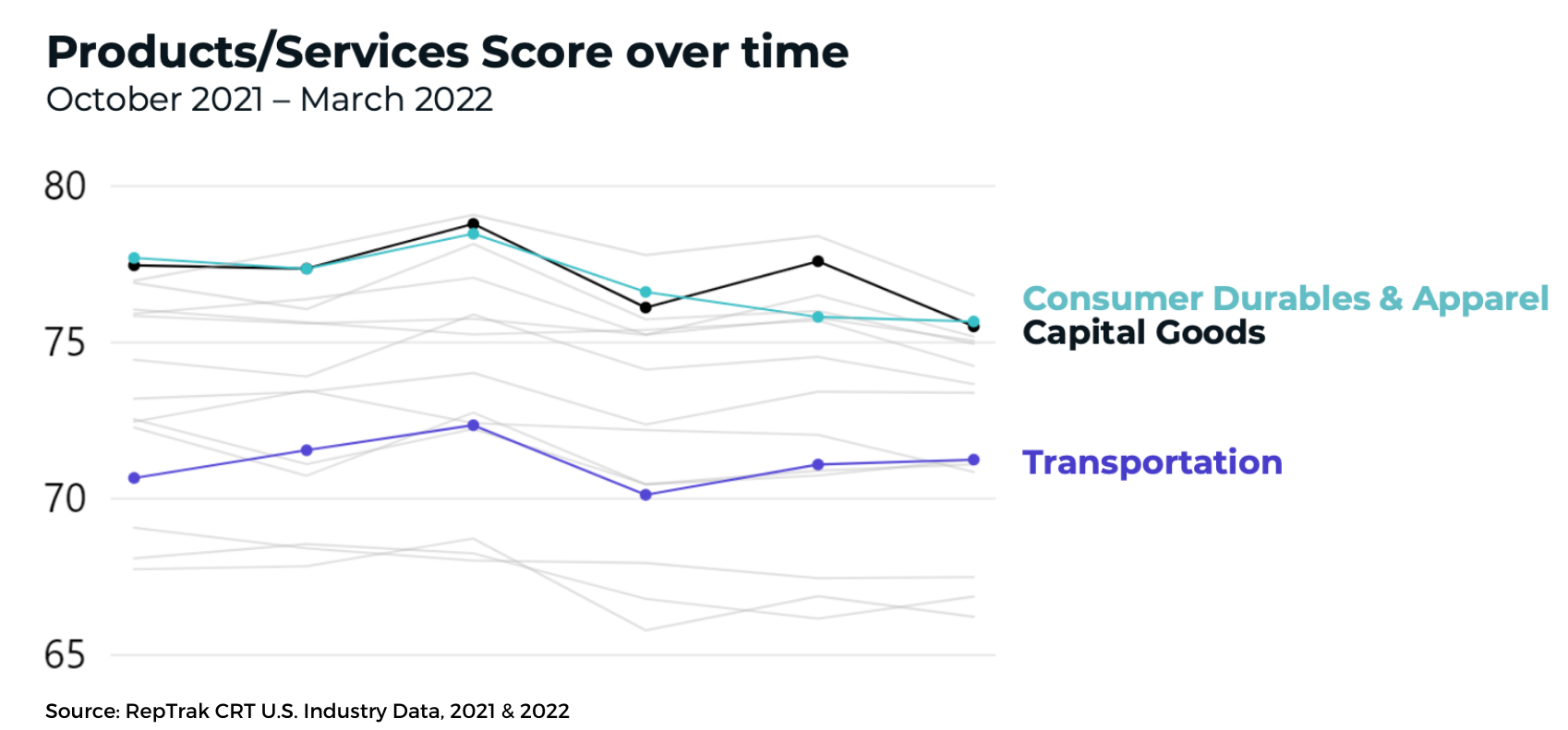

Under the Products/Services driver, twelve out of eighteen industries decreased in score from Q4 2021 to Q1 2022. However, after two years of COVID limitations, our data shows the industries that are coming back into the spotlight with consumers—and those who are falling out of favor.

Transportation had the largest increase in score up 0.8%.

On the other hand, Consumer Durables & Apparel had the largest decrease by 2.6%. And since December 2021, Capital Goods fell by 4.2% in just 3 months.

It seems like the ideas in Ewan McGregor’s “Stuff” commercial for Expedia on “the places we didn’t go” versus “the things we didn’t buy” is resonating with consumers. Are those Reputation Scores from above coming into focus? Consumers don’t just want “stuff,” they want reliable and lasting experiences from the products and services they use across industries—especially after a long few years indoors. Remember, it’s important you communicate to consumers how you align with their experiential values.

Trains, Planes... and Automobiles and Components

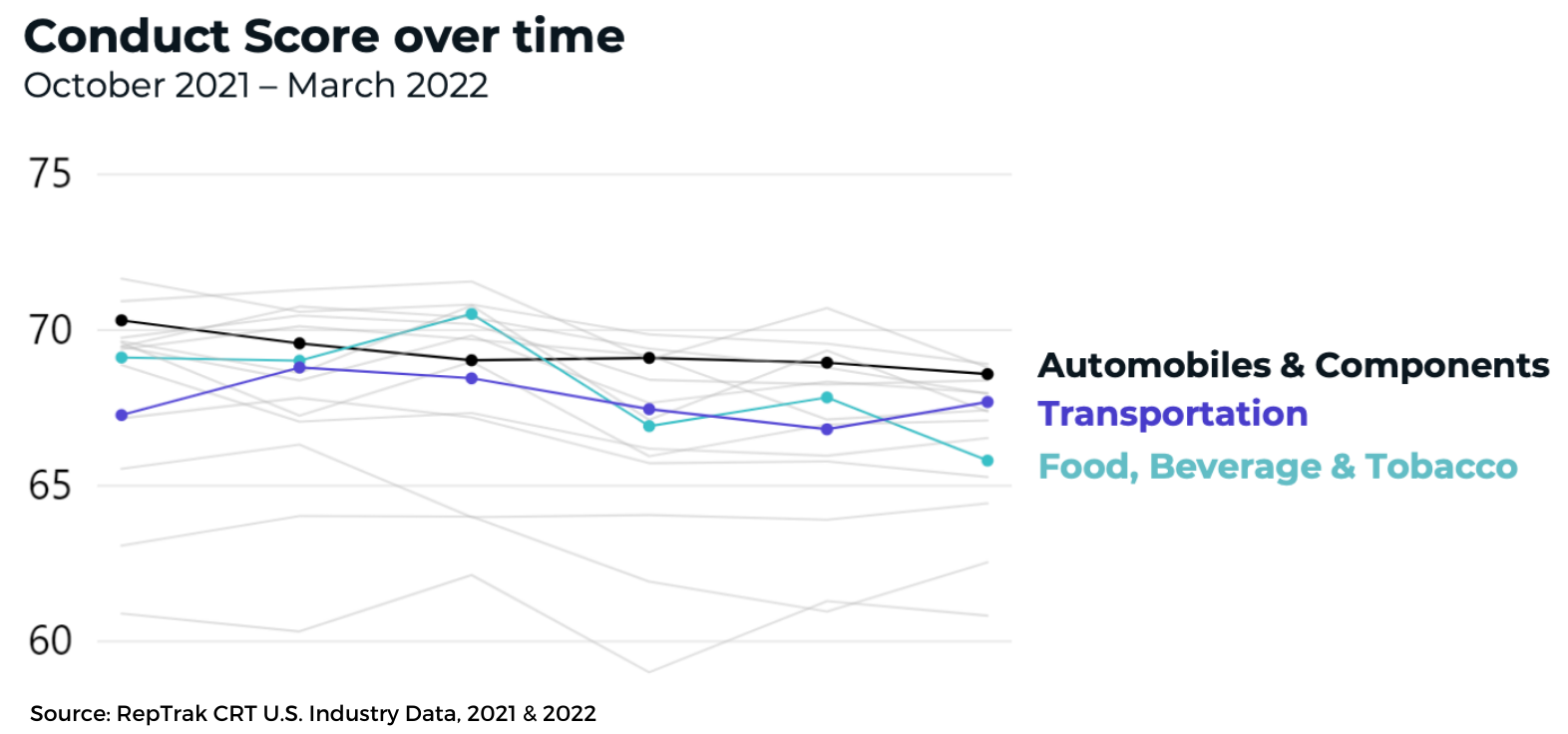

Two other Reputation drivers indicate that the Transportation industry is looking good to consumers across the board. Under Conduct and Leadership, Transportation had the largest increase by 0.6% in both categories.

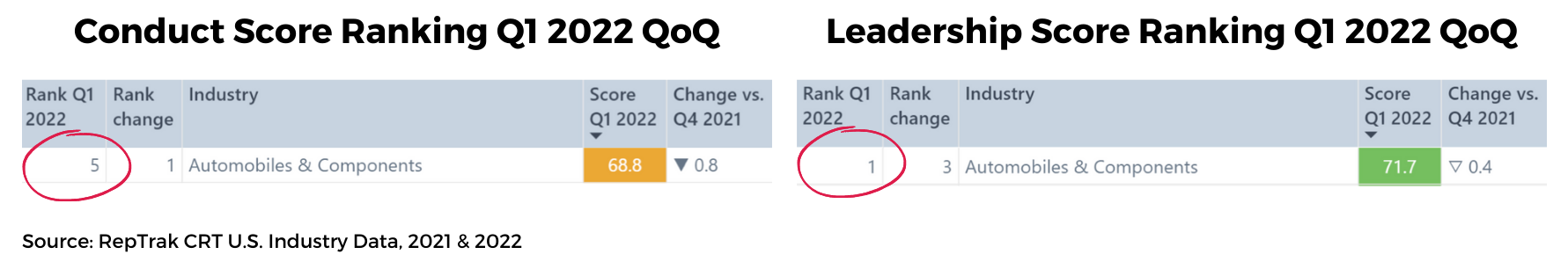

Yet, we see that Automobiles & Components’ Conduct Score fell by 0.5 points in 2 months. While our desire to travel and our trust in the industry is recovering after the pandemic, high gas prices can put a strain on the relationship consumers have with their everyday relationship with the road.

However, under Leadership, Automobiles & Components became the #1 industry in this category. Showing that consumers have more faith in the leaders of the Auto Industry. Alright now, say it with us: Communication with the public is crucial in boosting your Reputation!

To top off our shiny Q1 data with a big red car bow, the key takeaway is that stakeholders are ready to get out of their homes — but within reason. The stability offered by our household goods is still present, with Household & Personal Products remaining at #1 in the Products/Services, Citizenship, and Performance drivers. But don’t get too comfortable. With almost all scores on decreasing trends, those who are climbing now just might take those #1 spots in Q2 2022.

For more data insights, visit reptrak.com/blog.