When One Channel Isn't Enough: How Economic Complexity is Creating a New Channel Strategy

Corporate Reputation11 Feb, 2026

Recent RepTrak data shows an increasingly complicated corporate reputation environment, with the informed general public split on both the channels they trust and prefer, and their outlook on personal finances versus national economies.

Complicated environments are nothing new for corporate communications, but this one is especially tricky. For instance: How do you deliver positive updates to investors while remaining sensitive to cost-conscious consumers? How do you talk about value when stakeholders have radically different economic reference points?

The answer may well be simplifying.

Strong Leadership and Focused Messaging Matter More Than Ever

Recent RepTrak data shows a 1.1-point increase in belief that company leaders are "strong and appealing" in 2025. And 48% of stakeholders want to hear from CEOs about company vision, significantly ahead of other C-Suite leaders or spokespeople.

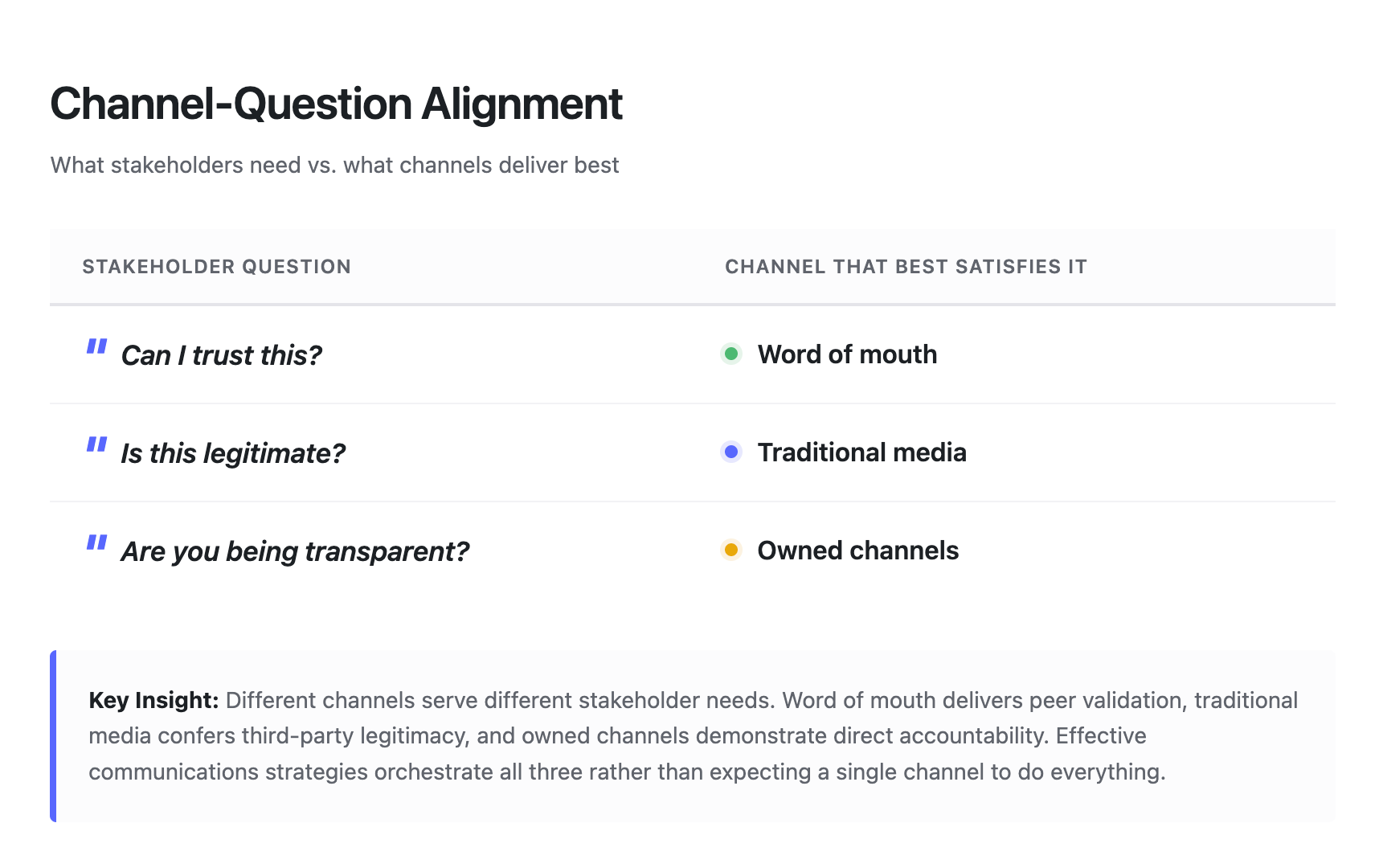

But leadership visibility alone isn't enough. The channel fragmentation creates a new challenge: messages now need to work across three different contexts simultaneously. When stakeholders are evaluating trust through word of mouth, legitimacy through traditional media, and transparency through owned channels, inconsistent messaging gets filtered out or distorted.

In fragmented environments, companies need fewer strategic messages repeated consistently across channels. Mixed messages—and even too many messages—don't just confuse; they undermine the transparency that 48% of stakeholders say they value in corporate communications.

The Three-Channel Reality

This isn't theoretical. The data shows these three needs diverging in real time.

How Credibility Has Fragmented Across Channels

Between Q4 2024 and Q4 2025, the channels stakeholders trust and desire shifted dramatically:

Most Trusted: Word of mouth rose from 32% to 39%, overtaking company websites (38%)

Most Desired: Traditional media rose from 28% to 35%, overtaking company websites (32%)

For the first time, the most trusted channel is not the most desired channel. This reveals three distinct needs:

Trust comes from word of mouth (39% trust). Stakeholders trust peer validation over institutional messaging, though they recognize its limited reach (only 25% desire).

Legitimacy comes from traditional media (35% desired). Traditional news confers third-party validation and scale, yet remains only third most trusted (28%).

Transparency comes from owned channels (32% trusted, 32% desired). Company websites remain critical but are no longer sufficient alone.

When economic conditions were unified, stakeholders could evaluate communications against a shared reality. Today, with fragmented economic experiences, stakeholders need multiple sources. No single channel can simultaneously provide trust, legitimacy, and transparency.

The Strategic Implication: Sequenced Credibility

The new reality requires orchestration across all three:

Foundation: Owned Channels. Establish baseline transparency. Ensure your website speaks directly to top reputation drivers.

Validation: Traditional Media. Leverage news coverage for third-party legitimacy, particularly for high-stakes announcements about economic positioning.

Amplification: Word of Mouth. Enable stakeholders to validate messages through their networks. Most trusted, least controllable.

In an environment where stakeholders navigate cognitive dissonance ("my finances are good, but the economy is bad"), single-channel messaging feels incomplete. Companies that rely on owned channels alone risk being dismissed as self-serving. Those that neglect owned channels sacrifice narrative control.

Where RepTrak Compass Fits: Measuring Credibility in a Fragmented Environment

When strategies change, leaders need to know: Is trust actually improving? Are we gaining legitimacy or just noise? Are owned channels reinforcing transparency or raising skepticism? As corporate communications begins matching their channel strategies to this new divergent media landscape, leaders will be pushed to answer these questions. RepTrak functions as a monitoring and learning system. It tracks shifts in reputation scores alongside Conduct, Leadership, and Performance. It monitors touchpoint reach and impact across earned, owned, and direct experience. And it identifies where credibility is strengthening and where fragmentation is becoming a risk.

RepTrak allows leaders to test whether strategy changes are closing credibility gaps, detect early warning signs before reputation scores fall, and move from assumption-based communications to evidence-based adjustment.